A MESSAGE OF APPRECIATION from the CADDO PARISH ASSESSOR

Every Citizen Matters

I am deeply honored and grateful for the trust and confidence the Citizens of Caddo Parish have placed in me by electing me as the Assessor of Caddo Parish. It is truly humbling. Thank you all for your support, dedication, and commitment. I wish to express my deepest gratitude to my Family. I would not be where I am today if they did not believe in me. I would like to especially thank my committee and supporters that stayed by my side every step of the way. I could not have completed this process without their continued assistance, guidance, encouragement, and support.

I take this responsibility very seriously. The Caddo Parish Assessor’s Office will ensure that fairness, equity, and respect is present in every aspect of our operations to secure quality services for every Citizen of Caddo Parish property. Every Citizen Matters in Caddo Parish. To achieve this, we will be innovative and anticipate the changing needs of our Citizens and embrace the latest technology. I will create a workplace for our team that inspires and empowers them to perform at the highest level. Our primary goal is to establish Fair and Equitable values for all properties in Caddo Parish.

Once again, thank you all for your unwavering support, dedication, and commitment. Yesterday, we celebrated, but today, the work has begun for Fair and Equitable Assessments for every Citizen in Caddo Parish.

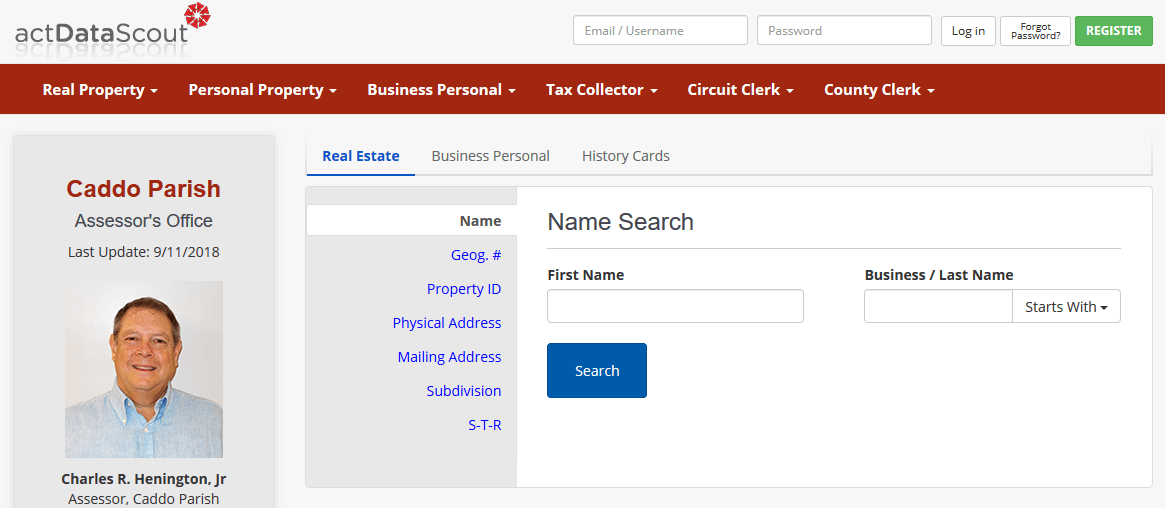

Free Public Search

Caddo Parish’s real estate records are available online and free to the public. We have made some new exciting upgrades to the free public search. Our constituents can now search by owner name, Section-Township-Range, and subdivision. You can also view the property on GIS maps.

Professional Searching

Real estate professionals who need value-added options and more powerful database query options will come to rely on the professional search. It has been said it changes the way people do business. And as a parish-sponsored program, we are glad to provide this product.

Interactive Mapping

Subscribers to the “Pro Search” can now search and view real property records with geospatial imaging layers. The map viewer incorporates a point-and-click application blended with parcel boundary layers. This Interactive Mapping tool will let subscribers visualize the property on a map, view the parcel boundary lines and approximate dimensions, and then link the parcel with its real property record card.

History Cards

Add history cards to your subscription with the History Card Search, which will enable you to search across three different sets of criteria. The results will allow you to look at all the images associated with a subdivision in a single book or you may browse through different pages that are associated with that subdivision. PDF versions of the history cards can be viewed, printed or saved to your hard drive.

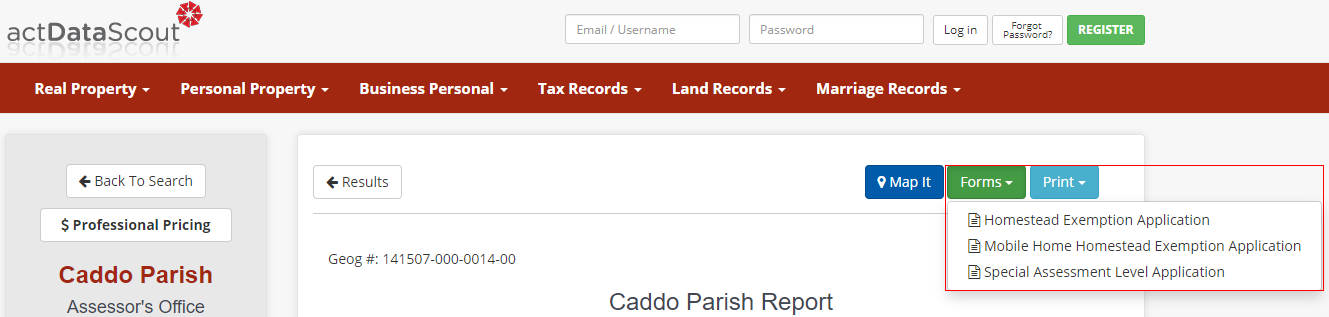

Homestead and Special Assessment Forms

Homestead Exemption

Homeowners who own and occupy their residence may qualify for Homestead Exemption.

Special Assessment Freeze

If you are 65 and older you may qualify for this special assessment freeze. To find out if you meet all of the requirements please contact our office.

How to Apply

To apply for Homestead Exemption and/or Special Assessment online, start by searching for your property.

Search Property